How to Get Your Finances Organized

THIS POST MAY CONTAIN AFFILIATE LINKS. MEANING I RECEIVE COMMISSIONS FOR PURCHASES MADE THROUGH THOSE LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

Less Debt More Wine is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com.

If you are just starting to realize that you need to get a handle on your finances you might be feeling overwhelmed with everything you think you should be doing. It’s okay; I’m going to walk you through the first step.

Before anything else, work on getting organized. When you are organized, it is easier to determine your next steps including financial goals, your budget, and how to spend and invest your money.

The ability to take action comes from getting your finances organized. Bonus, getting organized is an actionable step you can take even when feeling overwhelmed.

There are two things you are going to need to organize. First, your paperwork all the statements or terms going backward, second, is “the numbers” for your finances going forward.

Organizing Your Paperwork: Paper vs. Paperless

In the digital world we live in, going paperless is a very real option and may actually offer financial benefits. However, paper certainly has its place, and if you’re like me, you learned growing up how to open your mail, take action, and then file it away.

Right now, I have been sticking with paper though I’ve started the transition to paperless (mostly because I hate the clutter of my binders and files).

To each their own and if you don’t have a ton of loans like I do, you probably have significantly less clutter and no interest in going paperless. It is all good. The important thing is that no matter what method you use, you get your finances organized and keeping your finances organized going forward. So how to get your finances organized?

Paper

There are two main ways to keep your finances organized going the paper route, using Binders or a Filing cabinet, or a combination of both.

Binders

For example, I have Binders for my Student Loans (now 3 BINDERS!) and 1 Binder for my monthly expenses. Each binder is labeled on the outside of what it contains.

On the inside, I have dividers separating the loans or expenses. I also have tabs within those dividers to organize the type of documents (annual update, monthly statements, other). Here is how my Student Loan Binders were organized:

On the outside: I labeled by loan servicer

On the inside:

- I used dividers for each servicer

- A tab for each different loan, each servicer had (since some servicers had multiple loans)

- All of the paperwork is organized by date with the most recent first.

Filing Cabinet

My files are grouped by type (taxes, car, travel), and there is a file for each year or type of expense. For taxes, it is by year. For the Car section, I have the Loan info, insurance info and Car info (guide, etc.). I did start out with a color-coded system, but when I moved, it sort of lost its mojo. Which brings me to another point, your system of organization must be both simple (to you) and easy (for you) so that you can continue to maintain it going forward.

Necessary Supplies:

- Binders

- Tabs

- Hole Puncher

- Hanging File Folders

- File Folders

- Label Maker I <3 my label maker!

Paperless or Making the Switch to Paperless

To go paperless, you need to opt-in for paperless statements (some companies reward this action) and then make digital copies (scans) of the paperwork you already have. You will likely be using Folders on your computer to keep the scans organized. So how many folders and how to organize them?

As I work towards paperless I do the following and would recommend it:

Loans

- student loans

- car loan

- mortgage (I don’t have one, but thought you might)

- other loans

Income

- Taxes

- Job one pay statements

- Side hustle income

- Job two pay statements

Subscriptions/Monthly Bills

- Tv/cable

- phone

- Insurance

- Magazines

- Health (gym, weight watchers, etc.)

- Utility bills

When transferring from paper to paperless you will need to scan in the documents, but to be truly organized you will want all those documents to be easily searchable so you can quickly pull them up when needed. This means it will be a tedious process, but worth it in the end.

You’ll also be an expert at it in the end so any other papers you get going forward (it may take a billing period or two for the paperless statement request to process) will be scanned and labeled in a snap.

Due to the tediousness of the initial scanning party, I recommend having something else going on during your scanning marathon.

Some scanning party suggestions:

- A movie

- A drinking game for your scanning/labeling/saving documents party

- Music

- Podcasts (here are some of my favorites- Smart Passive Income, Listen Money Matters, So Money)

Just make it something fun to keep you awake and excited about a scanning party (ok that last part may be a stretch)

How to Scan and Label

I’m sure you know the technicality of how to create the folders, rename the documents and save them. What I mean by how to is scanning them by individual statements vs. in batches and labeling to make it easy to find.

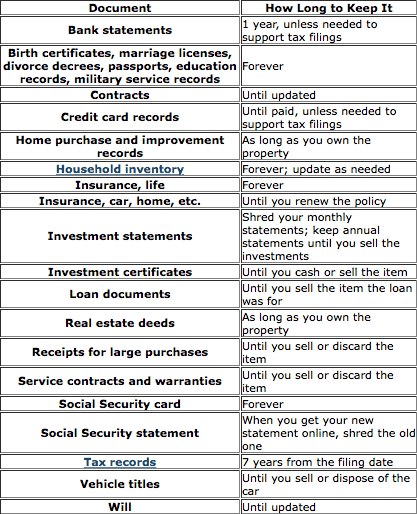

If you have multiple years worth of paperwork, first determine if it is something you need to keep at all. Here is a good guideline from usa.gov:

Remember to dispose of your financial documents properly, at a minimum; you should be shredding them. I know it is a pain to sit there and shred a TON of documents (if like me you didn’t keep up with it or are making a move from paper to paperless) but there is a lot of personal information in those documents.

Again make sure there is something else going on while you do this to keep you productive but also occupies your mind during the mindlessness of shredding (see suggestions above).

So after you have determined which documents you need to keep a copy of, group them by year. I tend to do both batch and individual statements. If I have paperwork going back multiple years, I will batch them by year and then scan individually for the current year.

At the end of the year, I will save the individual statements as a zip file for the year and start again with individual statements for the following year. Make sure to name the files you save with the dates they include and the type of document (statement, annual certification, etc.).

For example: FedLoanSvcstatements 2014 or FedLoanSvcStatement March 2015 Most importantly be consistent with how you are naming the documents, it makes it way easier to run a search for the document later.

Supplies Needed:

- Computer

- External Hardrive (for a backup copy, this is the one I use) or

- Flash Drive

Organizing “The Numbers” : Spreadsheets vs. Online Tools

The second step to getting your finances organized is pulling together all the numbers.

For any loans– what are the principal balances and interests rates, what is the accumulated interest on the loan.

For retirement accounts, what is your contribution rate, how much do you have invested already?

What regular annual or semi-annual bills do you have and how much are they? What are your regular monthly expenses?

It is a lot of information to pull from all that paperwork and to keep it all straight can be tough. Don’t worry there are tools out there that can help to do the heavy lifting.

Online Tools

There are various tools you can use to organize this information. You can put together a spreadsheet like I do or take advantage of various online tools, like mint.com or Personal Capital. I’ve used all of these tools, and they are great especially to get you started.

Ultimately, I like the control of a spreadsheet and haven’t used those online tools in a while, but I do check them from time to time because of the way they pull together information. Here is a brief description of what each of them does and oh ya, they are FREE.

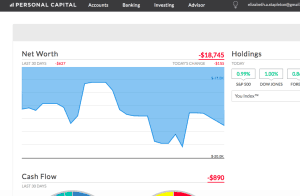

Personal Capital

What it does: Focuses on Wealth Management

Upside: It breaks out the positive parts of your net worth, which can really be a boost to your morale.

Downside: If you have debt, it is a little disheartening to regularly see your negative net worth.

Spreadsheets

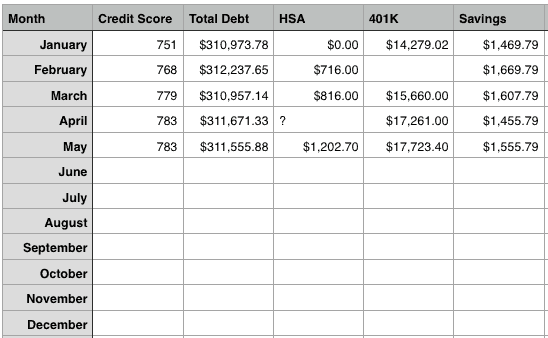

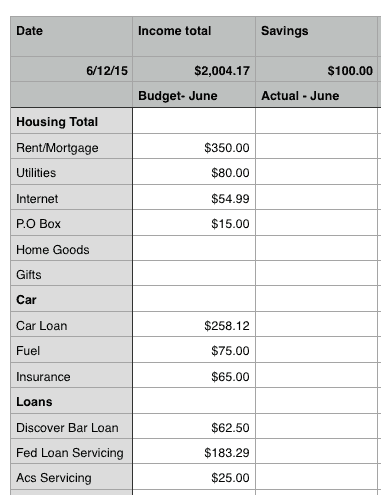

I prefer a spreadsheet that does all of the above. Below are some screenshots of my spreadsheets. Here is a list of all the spreadsheets I use:

An Overview

To keep track of my credit score, total debt, HSA, 401k, and savings.

Budget

Truthfully, I still bounce back and forth between a spreadsheet and paper/pen, but I’m working to make an effort.

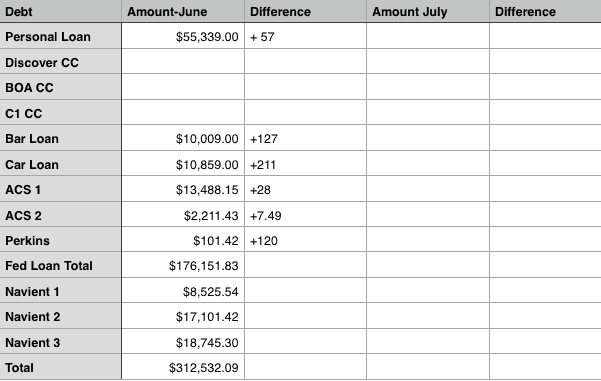

Debt

Unlike my Daily Interest worksheet, I keep track of the difference in my debt month to month

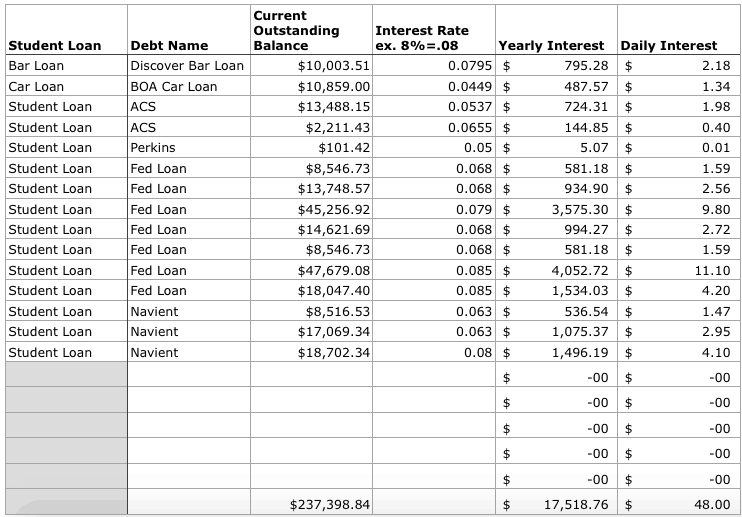

Daily Interest

I mentioned this one in my last post, and it is my biggest motivator. When I had my financial awakening, before I really started paying down my credit card debt, my debt was costing me $50 a day.

I know, it is insane. I’ve cut out $2 a day, saving myself over $700 a year. Seriously if you need some motivation, figure out how much money your debt is costing you every day.

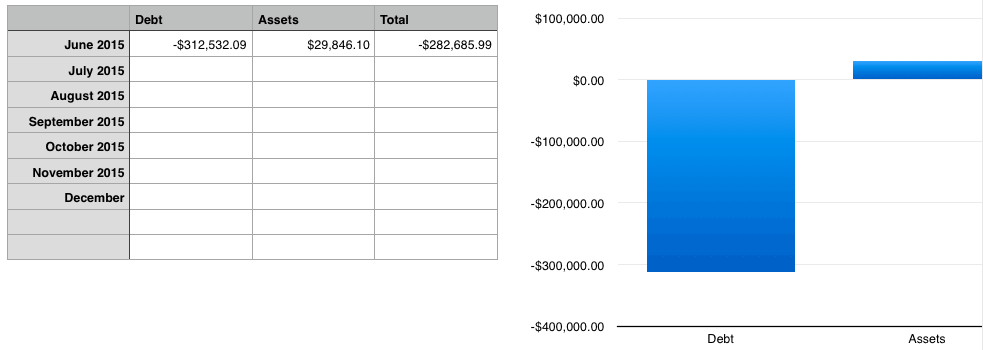

Net Worth

Yes, a negative net worth is depressing, but you know what? I’m gonna start from the bottom and make to the top.

Related: How to Calculate Your Net Worth

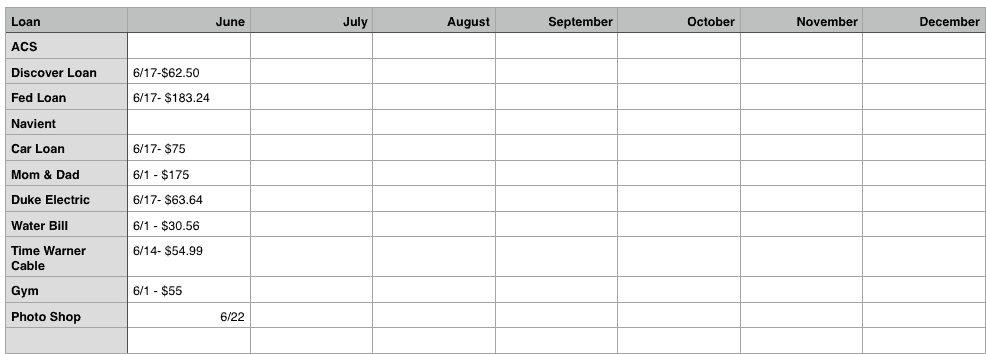

Payments

I keep track of what payments I made and when, since I split my payments bi-weekly, it can be easy to lose track.

You’ll notice that in my Payments worksheet I include all of my variable monthly bills, not just my minimum payments. Having a list of all your bills, including annual or semi-annual bills will come in handy later when you start to tackle creating a budget that works for you.

Wrapping it Up with a Bow on Top

No matter what system of organization you use, be it paper, paperless, different tools or a spreadsheet, what is important is that you get organized. Do what is going to work for you. You can’t set financial goals or move forward unless you know where you are starting. You’ll also be glad you wrote it all down somewhere when you look back a year from now and can see how much progress you’ve really made, even if it doesn’t always feel like it.

Did I forget anything? Have some other ideas to help get your finances organized? Let me know how you keep your finances organized in the comments below!

ok, this is super epic! My finances are very, very simple at the moment (earn, save, try not to bleed too much in spending, repeat) so my filing system is too, but this is totally comprehensive. I’m impressed.

Thanks!Even when finances are simple you are still keeping track so you can see your progress which is huge! Mine are a bit more complicated at the moment so organization is key, but I’m hoping that I’ll be able to simplify them more as I pay down my debt.

As soon as I saw “stop” in the opening paragraph, I thought “collaborate and listen.”

Also, I can’t believe you came up with an organizing drinking game. That’s incredible. And you know it’s totally a post in itself, right?

Haha, what a missed opportunity. I might need to go back and add it. Scanning and shredding is boring, drinking makes it more fun. lol.

I budget electronically, but for helping track of debts and pay offs I get all 1984 and prefer a paper method that has no possibility of manipulation. Comprehensive post!

Thanks! I like to mix both digital and paper tracking, the more place I have it, the more I’ll look at it and stay focused.

This is a great post Liz, I have a paper system at the moment but I’m thinking about transferring to online. I’m not sure I would be able to bear the task of scanning tons of documents in though, even with things going on to break up the tediousness!

Maybe I could keep my paper docs in an archive and start from scratch now online?

Thanks Hayley! I think starting from now is a great idea! I considered it myself, but the minimalist in me wanted to get rid of the clutter. It’s all a work in progress. 🙂

This is an awesome primer. I’m still very much a paper girl where it comes to my finances. I don’t love that though. But I can’t seem to wrap my head around making the switch. One day…when my life is less hectic I guess. 🙂

I know the feeling, but I like Hayley’s idea of starting from now on going digital, skip trying to convert what you already have and start fresh. You still have all your old documents, but aren’t building on top of that clutter.