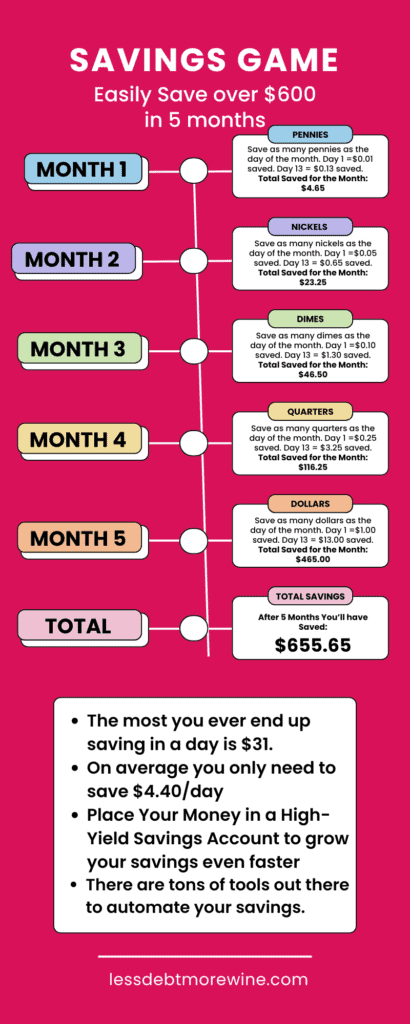

How to Easily Save Over $600 in 5 Months

THIS POST MAY CONTAIN AFFILIATE LINKS. MEANING I RECEIVE COMMISSIONS FOR PURCHASES MADE THROUGH THOSE LINKS, AT NO COST TO YOU. PLEASE READ MY DISCLOSURE FOR MORE INFO.

It’s amazing how saving consistently, a little bit each day, can really add up.

If you started with pennies one month and worked your way up to dollars in month 5, by saving the number of coins/dollars as the day of the month, you will save over $600. Start by saving 1 penny on day 1, then 2 pennies on day 2 and so on.

Month 1 & 2: Pennies & Nickels

| Pennies Day | Pennies Saved that Day | Total Monthly Savings |

|---|---|---|

| Day 1 | $0.01 | $0.01 |

| Day 2 | $0.02 | $0.03 |

| Day 3 | $0.03 | $0.06 |

| Day 4 | $0.04 | $0.10 |

| Day 5 | $0.05 | $0.15 |

| Day 6 | $0.06 | $0.21 |

| Day 7 | $0.07 | $0.28 |

| Day 8 | $0.08 | $0.36 |

| Day 9 | $0.09 | $0.45 |

| Day 10 | $0.10 | $0.55 |

| Day 11 | $0.11 | $0.66 |

| Day 12 | $0.12 | $0.78 |

| Day 13 | $0.13 | $0.91 |

| Day 14 | $0.14 | $1.05 |

| Day 15 | $0.15 | $1.20 |

| Day 16 | $0.16 | $1.36 |

| Day 17 | $0.17 | $1.53 |

| Day 18 | $0.18 | $1.71 |

| Day 19 | $0.19 | $1.90 |

| Day 20 | $0.20 | $2.10 |

| Day 21 | $0.21 | $2.31 |

| Day 22 | $0.22 | $2.53 |

| Day 23 | $0.23 | $2.76 |

| Day 24 | $0.24 | $3.00 |

| Day 25 | $0.25 | $3.25 |

| Day 26 | $0.26 | $3.51 |

| Day 27 | $0.27 | $3.78 |

| Day 28 | $0.28 | $4.06 |

| Day 29 | $0.29 | $4.35 |

| Day 30 | $0.30 | $4.65 |

| Nickels Day | Saved that Day | Total Monthly Savings |

|---|---|---|

| Day 1 | $0.05 | $0.05 |

| Day 2 | $0.10 | $0.15 |

| Day 3 | $0.15 | $0.20 |

| Day 4 | $0.20 | $0.50 |

| Day 5 | $0.25 | $0.75 |

| Day 6 | $0.30 | $1.05 |

| Day 7 | $0.35 | $1.40 |

| Day 8 | $0.40 | $1.80 |

| Day 9 | $0.45 | $2.25 |

| Day 10 | $0.50 | $2.75 |

| Day 11 | $0.55 | $3.30 |

| Day 12 | $0.60 | $3.90 |

| Day 13 | $0.65 | $4.55 |

| Day 14 | $0.70 | $5.25 |

| Day 15 | $0.75 | $6.00 |

| Day 16 | $0.80 | $6.80 |

| Day 17 | $0.85 | $7.65 |

| Day 18 | $0.90 | $8.55 |

| Day 19 | $0.95 | $9.50 |

| Day 20 | $1.00 | $10.50 |

| Day 21 | $1.05 | $11.55 |

| Day 22 | $1.10 | $12.65 |

| Day 23 | $1.15 | $13.80 |

| Day 24 | $1.20 | $15.00 |

| Day 25 | $1.25 | $16.25 |

| Day 26 | $1.30 | $17.55 |

| Day 27 | $1.35 | $18.90 |

| Day 28 | $1.40 | $20.30 |

| Day 29 | $1.45 | $21.75 |

| Day 30 | $1.50 | $23.25 |

Total Saved from Month 1 & 2 = $27.90

Month 3 & 4: Dimes & Quarters

| Dimes Day | Saved that Day | Total Monthly Savings |

|---|---|---|

| Day 1 | $0.10 | $0.10 |

| Day 2 | $0.20 | $0.30 |

| Day 3 | $0.30 | $0.60 |

| Day 4 | $0.40 | $1.00 |

| Day 5 | $0.50 | $1.50 |

| Day 6 | $0.60 | $2.10 |

| Day 7 | $0.70 | $2.80 |

| Day 8 | $0.80 | $3.60 |

| Day 9 | $0.90 | $4.50 |

| Day 10 | $1.00 | $5.50 |

| Day 11 | $1.10 | $6.60 |

| Day 12 | $1.20 | $7.80 |

| Day 13 | $1.30 | $9.10 |

| Day 14 | $1.40 | $10.50 |

| Day 15 | $1.50 | $12.00 |

| Day 16 | $1.60 | $13.60 |

| Day 17 | $1.70 | $15.30 |

| Day 18 | $1.80 | $17.10 |

| Day 19 | $1.90 | $19.00 |

| Day 20 | $2.00 | $21.00 |

| Day 21 | $2.10 | $23.10 |

| Day 22 | $2.20 | $25.30 |

| Day 23 | $2.30 | $27.60 |

| Day 24 | $2.40 | $30.00 |

| Day 25 | $2.50 | $32.50 |

| Day 26 | $2.60 | $35.10 |

| Day 27 | $2.70 | $37.80 |

| Day 28 | $2.80 | $40.60 |

| Day 29 | $2.90 | $43.50 |

| Day 30 | $3.00 | $46.50 |

| Quarters Day | Saved that Day | Total Monthly Savings |

|---|---|---|

| Day 1 | $0.25 | $0.25 |

| Day 2 | $0.50 | $0.75 |

| Day 3 | $0.75 | $1.50 |

| Day 4 | $1.00 | $2.50 |

| Day 5 | $1.25 | $3.75 |

| Day 6 | $1.50 | $5.25 |

| Day 7 | $1.75 | $7.00 |

| Day 8 | $2.00 | $9.00 |

| Day 9 | $2.25 | $11.25 |

| Day 10 | $2.50 | $13.75 |

| Day 11 | $2.75 | $16.50 |

| Day 12 | $3.00 | $19.50 |

| Day 13 | $3.25 | $22.75 |

| Day 14 | $3.50 | $26.25 |

| Day 15 | $3.75 | $30.00 |

| Day 16 | $4.00 | $34.00 |

| Day 17 | $4.25 | $38.25 |

| Day 18 | $4.50 | $42.75 |

| Day 19 | $4.75 | $47.50 |

| Day 20 | $5.00 | $52.50 |

| Day 21 | $5.25 | $57.75 |

| Day 22 | $5.50 | $63.25 |

| Day 23 | $5.75 | $69.00 |

| Day 24 | $6.00 | $75.00 |

| Day 25 | $6.25 | $81.25 |

| Day 26 | $6.50 | $87.50 |

| Day 27 | $6.75 | $94.50 |

| Day 28 | $7.00 | $101.50 |

| Day 29 | $7.25 | $108.75 |

| Day 30 | $7.50 | $116.25 |

Total saved after 4 months = $190.65

Month 5: Dollars

| Dollars Day | Saved that Day | Total Monthly Savings |

|---|---|---|

| Day 1 | $1.00 | $1.00 |

| Day 2 | $2.00 | $3.00 |

| Day 3 | $3.00 | $6.00 |

| Day 4 | $4.00 | $10.00 |

| Day 5 | $5.00 | $15.00 |

| Day 6 | $6.00 | $21.00 |

| Day 7 | $7.00 | $28.00 |

| Day 8 | $8.00 | $36.00 |

| Day 9 | $9.00 | $45.00 |

| Day 10 | $10.00 | $55.00 |

| Day 11 | $11.00 | $66.00 |

| Day 12 | $12.00 | $78.00 |

| Day 13 | $13.00 | $91.00 |

| Day 14 | $14.00 | $105.00 |

| Day 15 | $15.00 | $120.00 |

| Day 16 | $16.00 | $136.00 |

| Day 17 | $17.00 | $153.00 |

| Day 18 | $18.00 | $171.00 |

| Day 19 | $19.00 | $190.00 |

| Day 20 | $20.00 | $210.00 |

| Day 21 | $21.00 | $231.00 |

| Day 22 | $22.00 | $253.00 |

| Day 23 | $23.00 | $276.00 |

| Day 24 | $24.00 | $300.00 |

| Day 25 | $25.00 | $325.00 |

| Day 26 | $26.00 | $351.00 |

| Day 27 | $27.00 | $378.00 |

| Day 28 | $28.00 | $406.00 |

| Day 29 | $29.00 | $435.00 |

| Day 30 | $30.00 | $465.00 |

Total saved after month 5 = $655.65

Start with pennies and up the ante each month, in 5 months you will have saved over $650!

Month 1 you will save: $4.65

In Month 2 you will save: $23.25

Month 3 you will save: $46.50

In Month 4 you will save: $116.25

Month 5 you will have saved: $465.00

Total after 5 months: $655.65

Don’t Want to Build Up Savings Over Time?

If gradually building your savings isn’t your thing, the average savings over the course of the 5 months would amount to saving just $4.37 a day. So pack your lunch every day for 5 months and set aside the savings and you will easily save $655.65.

Related: How to Best Build Savings – Digital vs Manual

Still having trouble building savings? Give Chime or Qapital a try.

If you don’t want to open up a new bank account, then Qapital can help you reach savings goals. Once you have the Qapital App installed and a bank account (or in my case three) connected you set up a goal or goals. I currently have two, one to save for taxes #selfemployed and one to save for spending money when I travel hack my way to Paris. Then you set savings rules for each of your goals.

For example, I have a round up to the nearest $2 rule, a guilty spending rule -when I buy Dominos, and a savings rule for every time I hit my step goal with FitBit. There are tons of different savings rules you can set up. Bonus, when you use my link you’ll get $5 after your first savings.

What other savings tricks have you used? Let me know in the comments!